Összegzés

Highligts

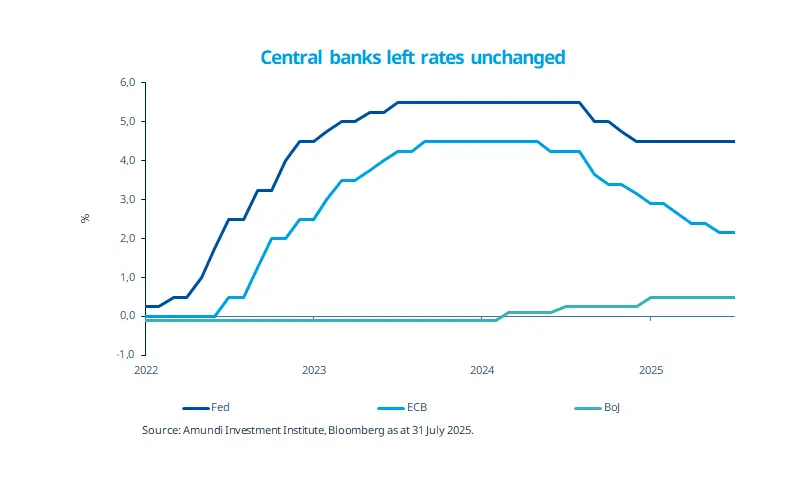

Global central banks are staying in a wait and watch mode as they assess the impact of US tariffs on the economy.

Trump has announced new tariffs and agreements that collectively raised the average US tariffs (vs. last year).

These tariffs will affect US inflation and growth, and investors may explore other regions where inflation is declining.

In this edition

Central banks in the US, Europe and Japan kept interest rates unchanged in their latest policy decisions. In addition to assessing growth and inflation, over the past few months these banks have been forced to deal with the potential economic ramifications of US trade policies. The July decision was the fifth consecutive time when the Fed held rates steady. It also outlined that growth in the first half has moderated but inflation remains elevated. In particular, the second quarter data showed that consumption is weakening, even without the complete effects of tariffs being felt by consumers. Looking ahead, we think the Fed is likely to monitor the effect of US tariffs on consumer spending, inflation and business decisions. The ECB appears more confident on inflation but would monitor tariffs, and the US-EU deal. In Asia, the Bank of Japan also left rates unchanged amid an eye on food prices.

Key dates

04 Aug US Durable Goods and Factory Orders | 07 Aug US Initial Jobless Claims, Bank of England Bank Rate, China Exports YoY |

08 Aug Canada Unemployment Rate |

Read more