Összegzés

In a nutshell

Spreads are now close to five-year lows. Spreads have completely (or almost) retraced the widening of “Liberation Day”.

Indeed, credit markets remain resilient in the face of (1) downside risks to growth linked to potentially higher tariffs and (2) rate volatility. The underlying global picture remains positive for credit markets. Risky assets remain supportive by resilient economic activity (despite rising risks) and central bank rate cuts.

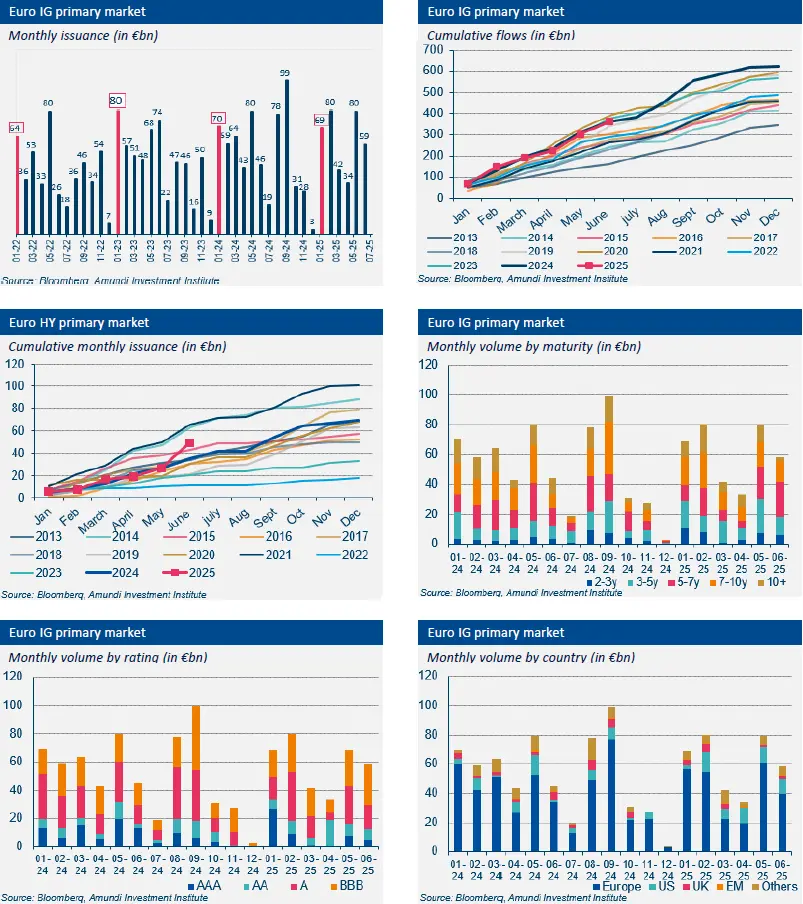

Activity on the primary market rebounded strongly in May and June after the decline recorded after “Liberation Day” (April 2, 2025). The weakness in primary market activity in April following the Liberation Day announcements was short-lived. The strong activity on the primary market has allowed companies to easily anticipate their next refinancing needs.

June continued to record very strong demand in both US and EUR credit markets. June and May were among the strongest months for inflows in both EUR IG and EUR HY. Investors remain attracted by the attractive level of yields. Yields remain anchored at attractive levels for both investment-grade (EU IG: 3.1%) and high-yieldbonds (EU HY: 5.3%).

Corporate fundamentals remain robust despite a lower growth backdrop. Private sector balance sheets are healthy. However, tariffs are clouding earnings visibility.

HY default rates downward trend came to a halt in May. Both Europe and the US were slightly up respectively to 2.2% from 2.1% and to 5.8% from 5.5%. Defaults keep being concentrated in lowest rated names and SMEs: CCCs are at 10% in US, while BB and B both close to 0.0%, while in terms of debt volumes default rates are still low by historical standards, below 2% both in US and Europe.

Primary market Investment Grade

Market data

Find out about our treasury offer